Tag: international education

-

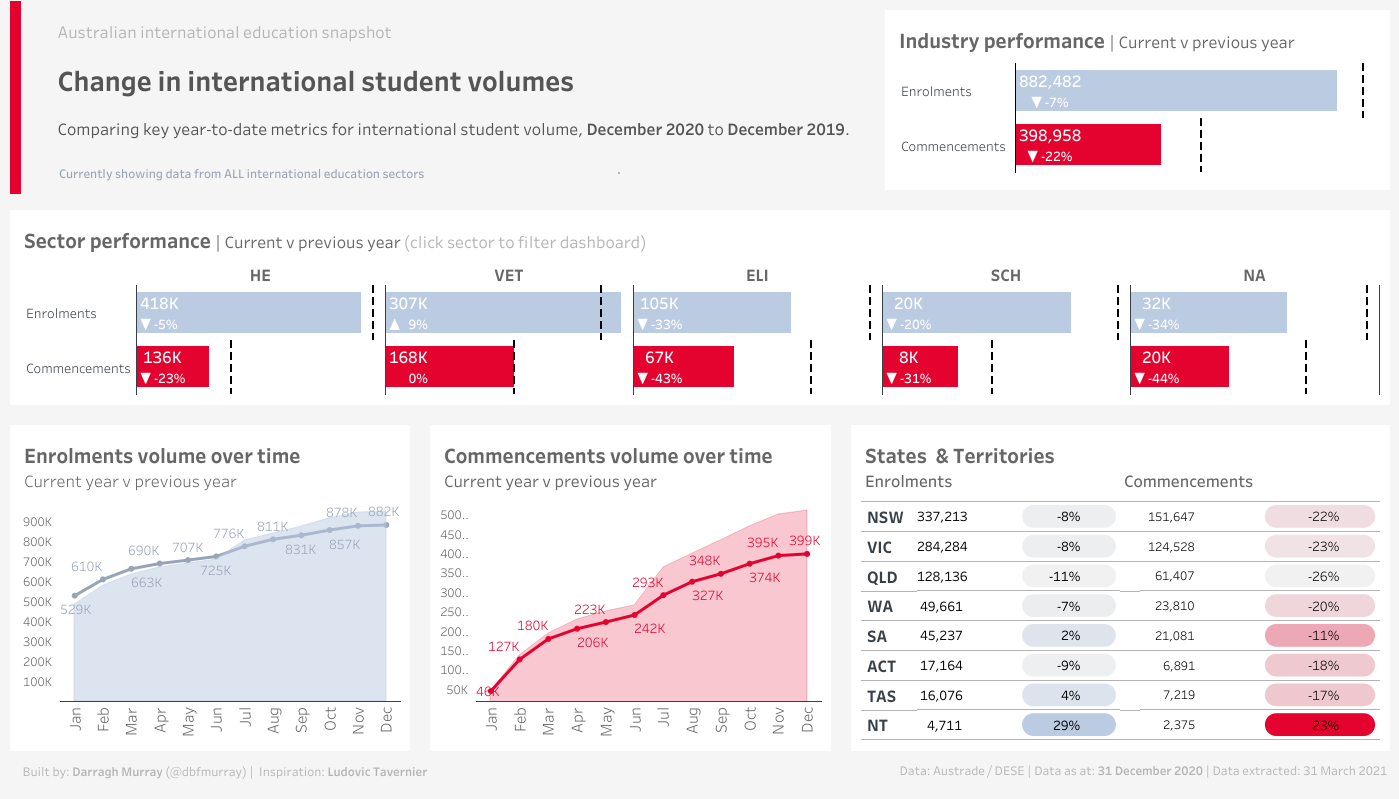

An updated Australian international education snapshot dashboard

I finally got around to updating my Australian international education snapshot dashboard. The original one, while I think was somewhat novel at the time, suffered from a fair few design flaws. Also, it didn’t render very well on Tableau Public. Since I originally did that viz, I’ve come quite some way in my Tableau abilities.…

-

A new take on international education student enrolment data by region: Experimenting with Tableau mapping

The Department of Education, Skills and Employment provide the international education sector in Australia with a large amount of very useful data on international students studying within our borders. Much of it is provided in a number of formats – from pivot tables made available through Austrade’s Market Information Package to a range of data…

-

NZIEC 2017: Some reflections on a whirlwind trip to Auckland.

On the flight back to Australia, I got the opportunity to reflect a little on the New Zealand International Education Conference I had just attended in Auckland. Overall, a fun, though slightly tiring, slog across the Tasman. I got to meet a heap of new people in and around the conference and was lucky enough…

-

Let the good times roll: March student visa statistics indicate continued growth in Australian international education.

Just last week, it happened that I was sitting at home in front of my laptop with a glass of red wine in my hand when I noted the Department of Immigration and Border Protection had released their latest visa statistics on international students. This sounds a tad depressing in retrospect, but the mood did…

-

The Data Game: Building Analytics Capability in International Education

[Originally published by IEAA’s Vista Magazine (Summer 2016/17) — I’d strongly recommend following them online and reading their publications if you’re interested in Australian international education!] Embracing an analytic mindset and capitalising on the technologies in the era of big data are key to reaching Australia’s strategic international education goals, writes Darragh Murray. A tale of prediction…

-

Australian international education market performs well in ICEF agent barometer

The ever comprehensive ICEF Monitor has published some early results from their eight annual agent barometer survey (co published with iGraduate). Given the lifting on the ban on foreign agents in US institutions, it is perhaps not unexpected that agents would be referring more students to US institutions – the barometer reports that 80% of…